DHFL 9.30% Non-Cumulative Debentures (NCDs) – August 2016

After the successful issue of Edelweiss Housing Finance Limited (EHFL), DHFL, or Dewan Housing Finance Limited, is coming out with its issue of Non-Convertible Debentures (NCDs) from the coming Wednesday i.e. August 3, 2016. These NCDs will carry coupon rates in the range of 8.83% to 9.30%, resulting in an effective yield of 9.20% to 9.30% for the individual investors.

Though the issue is scheduled to close on August 16, it is highly unlikely that it doesn’t get oversubscribed in the first two days itself. Given a bumper response to the Edelweiss Housing Finance NCDs issue, this issue should also get oversubscribed on the first day itself.

Before we take a decision whether to invest in this issue or not, let’s first check the salient features of this issue.

Size & Objective of the Issue – The company plans to raise Rs. 400 crore from this issue, including the green shoe option of Rs. 300 crore. The company plans to use the issue proceeds for its lending and financing activities, to repay interest and principal of its existing borrowings and other general corporate purposes.

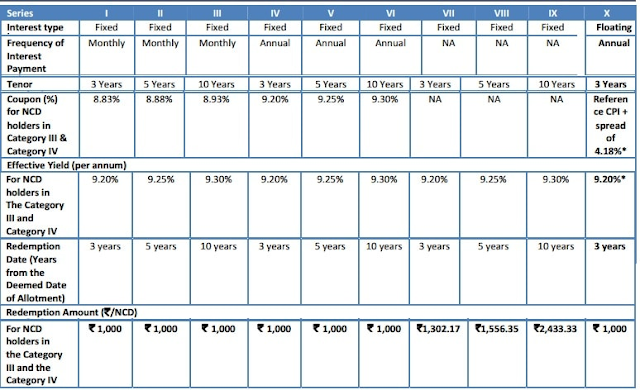

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.20% p.a. for a period of 3 years (36 months), 9.25% p.a. for 5 years (60 months) and 9.30% p.a. for 10 years (120 months). Investors will have the option to receive interest on a monthly, annual or cumulative basis.

CPI Linked Floating Interest Rate NCDs – This is the most unique feature of this issue. The company has decided to offer CPI-linked floating interest rate to its Series X NCD investors and there will be a ‘Floor’ as well as a ‘Cap’ on the interest rate. Floor has been set at 8.90% p.a. and Cap at 9.50% p.a. The specified spread will be 4.18% p.a. for Category III & Category IV investors. For the first year, reference CPI has got calculated at 5.02% p.a., so it is 5.02% + 4.18% = 9.20%.

Suppose, we have 4.72% as the reference CPI for the next year. In that case, the rate of interest will be 8.90% for the second year.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue i.e. Rs. 80 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue i.e. Rs. 80 crore

Category III – High Net Worth Individuals (HNIs) including HUFs – 30% of the issue is reserved i.e. Rs. 120 crore

Category IV – Resident Indian Individuals including HUFs – 30% of the issue is reserved i.e. Rs. 120 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CARE and Brickwork Ratings have rated this issue as ‘AAA’ with a ‘Stable’ outlook. Moreover, these NCDs will be ‘Secured’ in nature.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will get listed on both the national exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can always sell these bonds on the exchanges.

Demat, Physical Application – Demat account is not mandatory to invest in these NCDs as the investors have the option to apply for these NCDs in physical or certificate form as well.

TDS – Though the interest income would be taxable with these bonds, NCDs taken in demat form will not attract any TDS. The investor will have to pay tax on the interest income while filing his/her income tax return.

Should you invest in DHFL NCDs?

In 2013-14, when G-Sec yield was ruling above 9%, investors were scared to invest in debt securities due to negative returns on their investments. With falling yields on Government Securities (G-Secs) and corporate bonds, interest rates on various investment products like fixed deposits (FDs), post office small saving schemes, non-convertible debentures (NCDs) and tax-free bonds have all fallen by 1% to 2.5% in the last two years or so.

Now, with a fall in bond yields and 15-20% appreciation in bond prices, investors are chasing theses debt investments. But, I think that period of making easy money is over now and it would be very difficult for us to have similar returns going forward. Investors should not expect returns in double digits now on.

That being said, these rates of 9.20% to 9.30% do not attract me much, despite the issue being rated as ‘AAA’ by the rating agencies. I would rather prefer SBI NCDs yielding ~8.50% or Tax-Free Bonds yielding ~7% or equity mutual funds earning an average annual return of 15% or so. Conservative investors should avoid these NCDs and explore other options like post office saving schemes, tax-free bonds, debt mutual funds or other listed NCDs.

Investors, who are not required to pay any tax on their annual taxable income or who fall in the 10% tax bracket or who have high degree of confidence in the execution capabilities of DHFL’s management, can consider investing in these NCDs for a period of 3 years or at max 5 years. I personally avoid longer term investment periods with private companies, so would advise my clients too to avoid the 10-year option in this case.

Before we take a decision whether to invest in this issue or not, let’s first check the salient features of this issue.

Size & Objective of the Issue – The company plans to raise Rs. 400 crore from this issue, including the green shoe option of Rs. 300 crore. The company plans to use the issue proceeds for its lending and financing activities, to repay interest and principal of its existing borrowings and other general corporate purposes.

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.20% p.a. for a period of 3 years (36 months), 9.25% p.a. for 5 years (60 months) and 9.30% p.a. for 10 years (120 months). Investors will have the option to receive interest on a monthly, annual or cumulative basis.

CPI Linked Floating Interest Rate NCDs – This is the most unique feature of this issue. The company has decided to offer CPI-linked floating interest rate to its Series X NCD investors and there will be a ‘Floor’ as well as a ‘Cap’ on the interest rate. Floor has been set at 8.90% p.a. and Cap at 9.50% p.a. The specified spread will be 4.18% p.a. for Category III & Category IV investors. For the first year, reference CPI has got calculated at 5.02% p.a., so it is 5.02% + 4.18% = 9.20%.

Suppose, we have 4.72% as the reference CPI for the next year. In that case, the rate of interest will be 8.90% for the second year.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue i.e. Rs. 80 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue i.e. Rs. 80 crore

Category III – High Net Worth Individuals (HNIs) including HUFs – 30% of the issue is reserved i.e. Rs. 120 crore

Category IV – Resident Indian Individuals including HUFs – 30% of the issue is reserved i.e. Rs. 120 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CARE and Brickwork Ratings have rated this issue as ‘AAA’ with a ‘Stable’ outlook. Moreover, these NCDs will be ‘Secured’ in nature.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will get listed on both the national exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can always sell these bonds on the exchanges.

Demat, Physical Application – Demat account is not mandatory to invest in these NCDs as the investors have the option to apply for these NCDs in physical or certificate form as well.

TDS – Though the interest income would be taxable with these bonds, NCDs taken in demat form will not attract any TDS. The investor will have to pay tax on the interest income while filing his/her income tax return.

Should you invest in DHFL NCDs?

In 2013-14, when G-Sec yield was ruling above 9%, investors were scared to invest in debt securities due to negative returns on their investments. With falling yields on Government Securities (G-Secs) and corporate bonds, interest rates on various investment products like fixed deposits (FDs), post office small saving schemes, non-convertible debentures (NCDs) and tax-free bonds have all fallen by 1% to 2.5% in the last two years or so.

Now, with a fall in bond yields and 15-20% appreciation in bond prices, investors are chasing theses debt investments. But, I think that period of making easy money is over now and it would be very difficult for us to have similar returns going forward. Investors should not expect returns in double digits now on.

That being said, these rates of 9.20% to 9.30% do not attract me much, despite the issue being rated as ‘AAA’ by the rating agencies. I would rather prefer SBI NCDs yielding ~8.50% or Tax-Free Bonds yielding ~7% or equity mutual funds earning an average annual return of 15% or so. Conservative investors should avoid these NCDs and explore other options like post office saving schemes, tax-free bonds, debt mutual funds or other listed NCDs.

Investors, who are not required to pay any tax on their annual taxable income or who fall in the 10% tax bracket or who have high degree of confidence in the execution capabilities of DHFL’s management, can consider investing in these NCDs for a period of 3 years or at max 5 years. I personally avoid longer term investment periods with private companies, so would advise my clients too to avoid the 10-year option in this case.

Comments

Post a Comment