Algorithmic Trading Life Cycle of Algo Components for Development

Algorithmic Trading Life Cycle of Algo Components

Algorithms are used extensively in various stages of the trading cycle. we can classify them into pre-trade analytics, execution stage, and post-trade analytics.

The Pre-trade analytics involve thorough analysis of historical data and current price and volume data to help clients determine where to send orders and when; whether to use algorithms or trade an order manually we can call this as back testing the algorithm etc.,. The pre-trade analysis is designed to help buy-side traders understand and minimize market impact by choosing the level of aggressiveness and a time horizon for trading various stocks. Traders can select varying levels of aggressiveness and visualize them against the time horizon for completing the trade. Most compare the spread between bid and ask prices, reference that against the volatility of a given stock, and attempt to create a range of potential outcomes. A lot of the broker-sponsored algorithmic trading systems attempt to measure or project the trade costs.

The Pre-trade analytics involve thorough analysis of historical data and current price and volume data to help clients determine where to send orders and when; whether to use algorithms or trade an order manually we can call this as back testing the algorithm etc.,. The pre-trade analysis is designed to help buy-side traders understand and minimize market impact by choosing the level of aggressiveness and a time horizon for trading various stocks. Traders can select varying levels of aggressiveness and visualize them against the time horizon for completing the trade. Most compare the spread between bid and ask prices, reference that against the volatility of a given stock, and attempt to create a range of potential outcomes. A lot of the broker-sponsored algorithmic trading systems attempt to measure or project the trade costs.

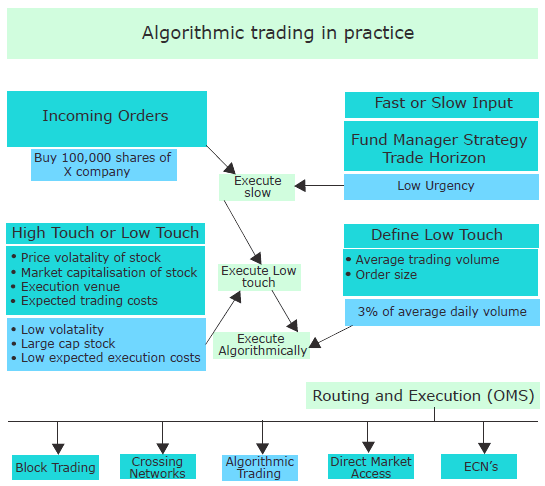

In the Execution stage, traders can create the lists of stocks, choose a particular strategy such as implementation shortfall and enter the start time and the end time. Traders can also monitor the performance and progress of the algorithms in real time and change the parameters if the stock is moving away. Additionally, users can filter portfolios by sector, market cap, exchange, basket, and percent of volume, profit and loss per share. Several brokers are designing algorithms that sweep crossing networks and so-called dark books liquidity pools that match buy and sell orders without publishing a quote.

Post-trade analytics track commissions and assist in uncovering the costs involved from the time a trade is initiated all the way through to execution. Post-trade analytics are meant to improve execution quality and facilitate the making of investment decisions. The most prevalent trading benchmark in use today is VWAP, which is popular because it is easy to measure. Although it provides comparative results, it is not as useful for evaluating strategies that are trying to do something other than follow the market midpoint.For example, if a stock is not liquid, if one trades a large volume of stocks over the course of the day and measures it using VWAP metric, one becomes the VWAP.

Some of the generic issues involved in choosing appropriate execution method

Comments

Post a Comment