DHFL 9.30% Non-Cumulative Debentures (NCDs) – August 2016

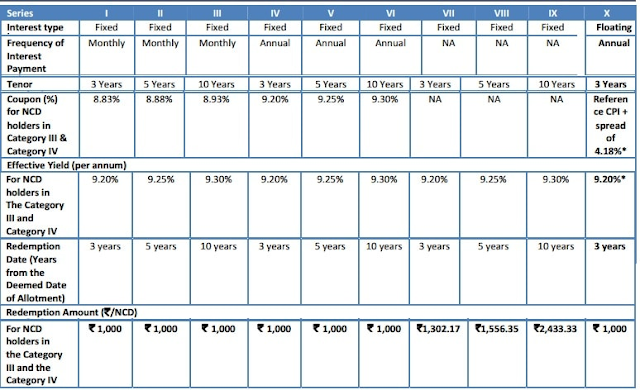

After the successful issue of Edelweiss Housing Finance Limited (EHFL), DHFL, or Dewan Housing Finance Limited, is coming out with its issue of Non-Convertible Debentures (NCDs) from the coming Wednesday i.e. August 3, 2016. These NCDs will carry coupon rates in the range of 8.83% to 9.30%, resulting in an effective yield of 9.20% to 9.30% for the individual investors. Though the issue is scheduled to close on August 16, it is highly unlikely that it doesn’t get oversubscribed in the first two days itself. Given a bumper response to the Edelweiss Housing Finance NCDs issue, this issue should also get oversubscribed on the first day itself. Before we take a decision whether to invest in this issue or not, let’s first check the salient features of this issue. Size & Objective of the Issue – The company plans to raise Rs. 400 crore from this issue, including the green shoe option of Rs. 300 crore. The company plans to use the issue proceeds for its lending and financing acti